All Categories

Featured

Table of Contents

It's still completely funded in the eyes of the mutual life insurance policy business. It's vital that your plan is a combined, over-funded, and high-cash value policy.

Riders are additional functions and advantages that can be contributed to your policy for your details demands. They let the insurance holder acquisition extra insurance coverage or alter the problems of future purchases. One factor you might desire to do this is to plan for unexpected health and wellness troubles as you get older.

If you include an added $10,000 or $20,000 upfront, you'll have that money to the bank initially. These are just some steps to take and consider when establishing up your way of living financial system. There are a number of different methods in which you can make the most of way of living financial, and we can assist you find te best for you.

Concept Bank

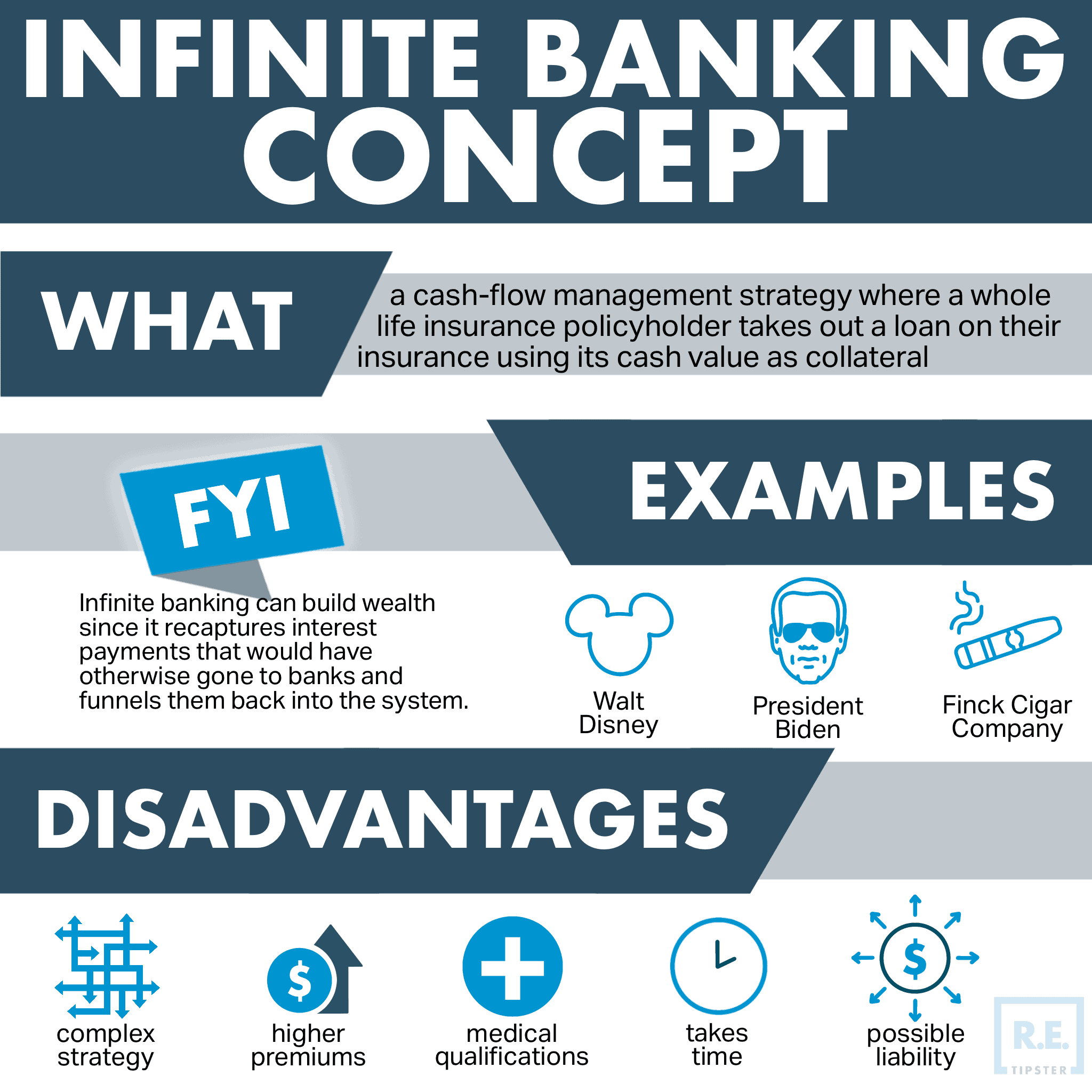

When it comes to financial preparation, whole life insurance policy commonly stands out as a preferred option. However, there's been a growing pattern of advertising and marketing it as a device for "boundless financial." If you have actually been exploring whole life insurance policy or have actually encountered this concept, you could have been informed that it can be a means to "become your own financial institution." While the idea might seem enticing, it's critical to dig deeper to comprehend what this actually indicates and why checking out whole life insurance policy this way can be misleading.

The idea of "being your own financial institution" is appealing since it suggests a high degree of control over your funds. This control can be imaginary. Insurance provider have the supreme say in exactly how your policy is managed, consisting of the regards to the fundings and the rates of return on your cash money value.

If you're thinking about whole life insurance, it's important to watch it in a wider context. Whole life insurance policy can be a valuable tool for estate planning, offering an ensured survivor benefit to your beneficiaries and possibly providing tax advantages. It can likewise be a forced cost savings car for those who struggle to conserve cash constantly.

It's a kind of insurance with a financial savings part. While it can use stable, low-risk growth of cash value, the returns are generally less than what you may achieve with other financial investment automobiles. Prior to delving into entire life insurance with the concept of unlimited financial in mind, take the time to consider your financial goals, danger tolerance, and the complete series of monetary items readily available to you.

Limitless banking is not a monetary panacea. While it can operate in particular scenarios, it's not without threats, and it requires a considerable commitment and recognizing to handle efficiently. By identifying the prospective risks and comprehending the true nature of whole life insurance policy, you'll be much better geared up to make an enlightened choice that sustains your financial wellness.

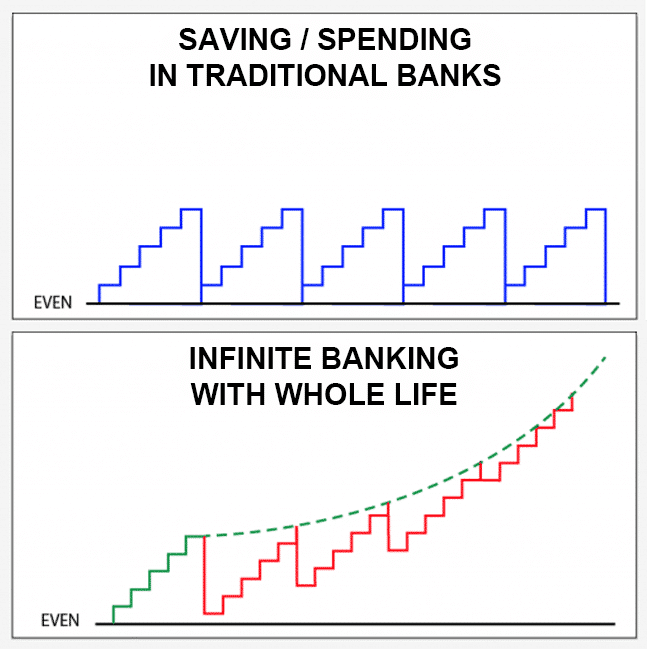

As opposed to paying banks for points we need, like cars, houses, and institution, we can invest in ways to maintain more of our money for ourselves. Infinite Financial approach takes an innovative strategy towards personal money. The approach essentially involves becoming your very own financial institution by utilizing a dividend-paying whole life insurance coverage policy as your bank.

Nelson Nash Infinite Banking

It gives substantial growth over time, transforming the basic life insurance coverage policy into a tough economic device. While life insurance coverage firms and banks take the chance of with the change of the market, the negates these dangers. Leveraging a cash money worth life insurance policy plan, individuals take pleasure in the advantages of guaranteed development and a fatality benefit safeguarded from market volatility.

The Infinite Financial Principle illustrates exactly how much riches is completely moved away from your Household or Company. Nelson also takes place to describe that "you finance every little thing you buyyou either pay rate of interest to somebody else or quit the passion you could have or else made". The genuine power of The Infinite Financial Principle is that it solves for this problem and empowers the Canadians that accept this idea to take the control back over their financing needs, and to have that money flowing back to them versus away.

This is called shed possibility price. When you pay cash for things, you completely surrender the possibility to earn passion by yourself cost savings over multiple generations. To fix this trouble, Nelson created his own financial system with making use of dividend paying getting involved whole life insurance policy plans, ideally through a mutual life business.

As a result, insurance holders should thoroughly evaluate their financial goals and timelines before choosing for this technique. Sign up for our Infinite Banking Training Course.

Life Insurance Infinite Banking

Exactly how to get UNINTERRUPTED COMPOUNDING on the normal contributions you make to your savings, emergency fund, and retirement accounts How to position your hard-earned cash so that you will certainly never ever have an additional sleep deprived evening stressed regarding just how the markets are going to respond to the following unfiltered Governmental TWEET or international pandemic that your family members merely can not recoup from How to pay yourself initially making use of the core principles instructed by Nelson Nash and win at the cash video game in your own life Exactly how you can from third event financial institutions and loan providers and move it into your own system under your control A structured method to make certain you pass on your wealth the method you want on a tax-free basis Just how you can move your cash from for life exhausted accounts and shift them into Never ever taxed accounts: Listen to exactly just how individuals simply like you can execute this system in their own lives and the influence of putting it right into activity! The period for establishing and making substantial gains with boundless banking mainly depends on numerous variables unique to a person's monetary placement and the plans of the financial establishment catering the service.

Moreover, a yearly dividend repayment is one more huge advantage of Unlimited financial, additional emphasizing its beauty to those tailored in the direction of long-term financial development. Nonetheless, this approach calls for cautious consideration of life insurance coverage costs and the analysis of life insurance policy quotes. It's important to analyze your credit scores report and face any kind of existing credit card financial debt to make sure that you are in a desirable position to embrace the strategy.

An essential element of this strategy is that there is insensitivity to market changes, because of the nature of the non-direct acknowledgment loans used. Unlike financial investments connected to the volatility of the marketplaces, the returns in unlimited financial are steady and foreseeable. However, money beyond the costs payments can likewise be contributed to accelerate growth.

Infinite Banking Software

Insurance policy holders make routine costs settlements right into their taking part whole life insurance policy plan to keep it in pressure and to construct the plan's total cash value. These premium settlements are normally structured to be consistent and predictable, making certain that the policy stays energetic and the cash value remains to expand with time.

The life insurance coverage policy is created to cover the entire life of a private, and not simply to help their beneficiaries when the private passes away. That stated, the plan is getting involved, indicating the plan owner comes to be a part owner of the life insurance policy company, and joins the divisible earnings produced in the kind of returns.

When returns are chunked back into the plan to purchase paid up additions for no additional expense, there is no taxed occasion. And each paid up enhancement likewise obtains dividends every single year they're stated. rbc infinite private banking.

Latest Posts

Infinite Banking Reviews

How To Use Whole Life Insurance As A Bank

Bank On Yourself Ripoff